Investment Booster 2025: Degressive depreciation for office furniture (Germany)

More liquidity through faster tax savings

In 2025, before the summer recess, the German federal government implemented the so-called investment booster. A key component of this is the reintroduction of declining balance depreciation (AfA) for movable assets – including office furniture such as telephone and meeting boxes. The idea behind this is that the increased depreciation options lead to a lower tax burden in the first few years after purchase, thereby increasing liquidity in the medium term.

Legal notice: No legal or tax advice

The information provided on this website is for general information purposes only. It does not constitute legal or tax advice and cannot replace such advice.

What is declining balance depreciation and why is it an investment booster?

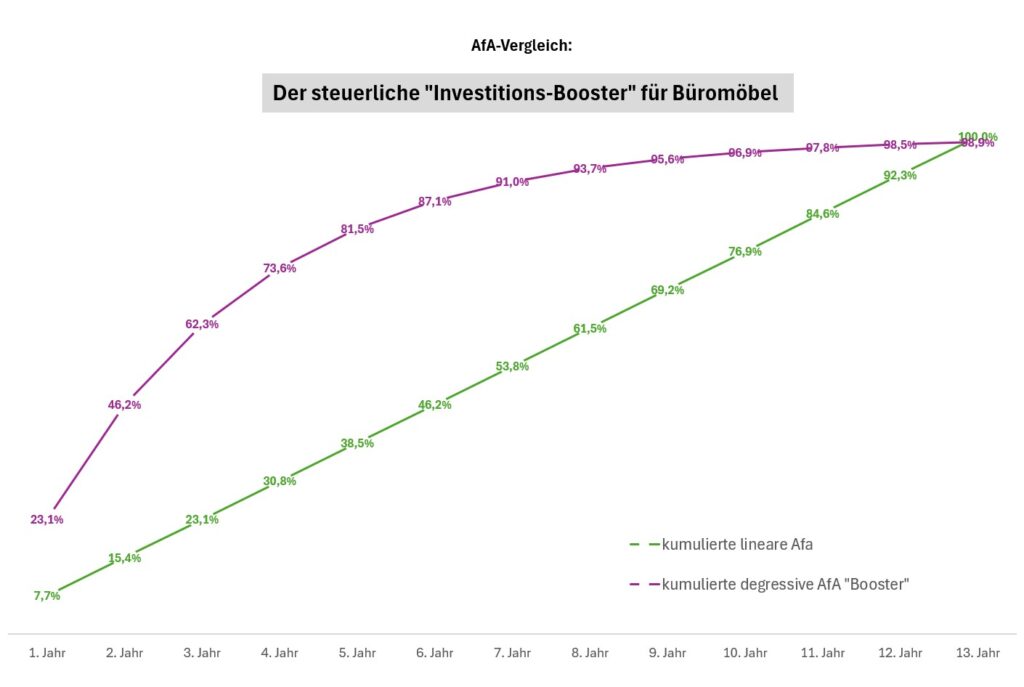

Declining balance depreciation allows higher depreciation amounts to be claimed in the first few years after acquisition. Specifically, companies will in future be able to depreciate up to 30% of the (residual) book value per year – up to a maximum of three times the normal straight-line depreciation. This means that instead of depreciating smaller amounts on a straight-line basis over what is often a long useful life, the majority of the investment costs will have a prompt tax effect.

This "turbo effect" significantly improves liquidity, as companies save more taxes in the year of investment and subsequent years, thus gaining financial leeway for further growth.

The declining balance method of depreciation has been adopted in Germany for a period of two and a half years and applies to all purchases and investments made between 1 July 2025 and 31 December 2027.

Example: Investment in telephone and meeting boxes

Phone boxes and meeting boxes are key pieces of equipment in modern offices for focussed conversations and productive meetings. Many companies are currently looking to upgrade here. Let's assume your company invests €10,000 net in such office furniture with a standard straight-line amortisation period of 13 years.

- Linear: Annual depreciation of around €770 spread over 13 years.

- Degressive: In the first year, you can depreciate up to 30% (maximum £2,310 = 3 x linear annual value); in subsequent years, the depreciation decreases with the residual value, but remains higher than with linear depreciation in the first five years (viewed annually).

As shown in the diagram above, this results in faster tax relief in the first few years, which increases cash flow and makes your investment more economically attractive.

Renting as an alternative

If you are interested in tax deductibility and have cash flow optimisation in mind, you should also consider the topic of renting: In this case, the liquidity advantage does not only arise through tax effects in the annual financial statements, but directly with the rental (monthly instalment vs. purchase price). Incidentally, the monthly rental fees can also be claimed as business expenses for tax purposes at 100%.

Feel free to contact us!

Whether you want to buy with an "investment booster", rent or lease, we will be happy to advise you on our extensive selection of telephone and meeting boxes:

-

Silen Chatbox Single | Phone booth (Silen)

per month from 98,00€ plus VAT. Show details -

Jetson S1 phone booth (MUTE)

per month from 98,00€ plus VAT. Show details -

Jetson M1 work booth (MUTE)

per month from 131,00€ plus VAT. Show details -

Silen Chatbox Solo | Work booth (Silen)

per month from 127,00€ plus VAT. Show details -

2-seater meeting booth Jetson L2 (MUTE)

per month from 180,00€ plus VAT. Show details -

Meeting Booth Jetson L4 (MUTE)

per month from 194,00€ plus VAT. Show details -

Silen Chatbox Duo | Meeting booth (Silen)

per month from 161,00€ plus VAT. Show details -

Silen Chatbox Quattro | Meeting booth (Silen)

per month from 279,00€ plus VAT. Show details